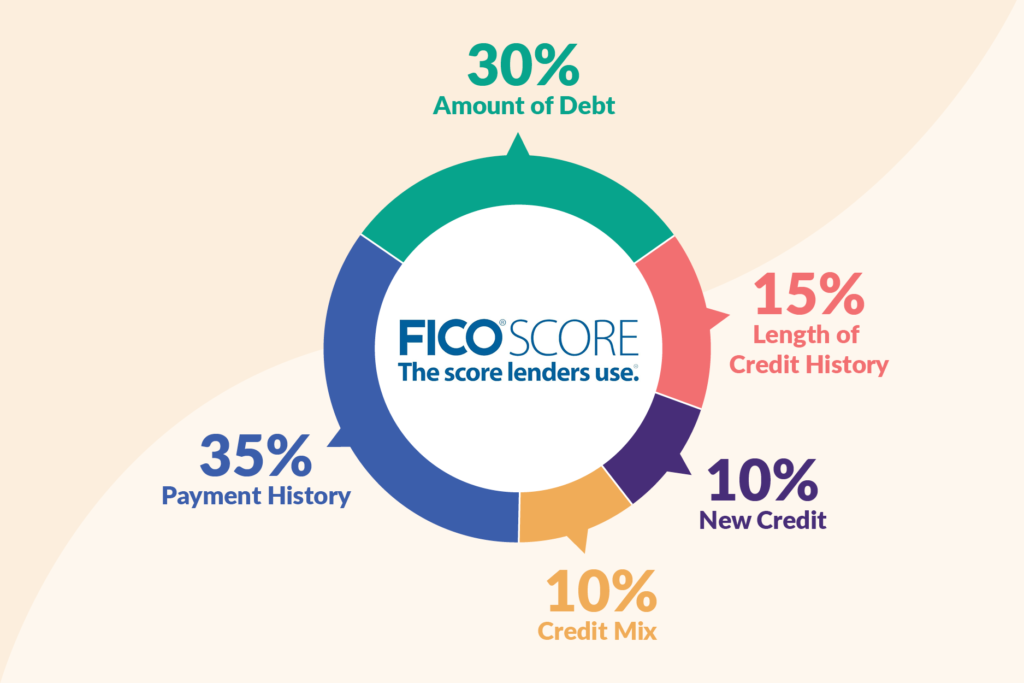

Ever wondered why your credit score is what it is?

Your credit score isn’t random—it’s based on key factors that lenders use to determine your financial reliability. Whether you’re trying to boost your score or just maintain good credit, understanding these factors is the first step toward better financial health.

In this guide, we’ll break down the five major factors that affect your credit score and how you can use them to your advantage.

1. Payment History (35%) – The Most Important Factor

Your payment history makes up the biggest portion of your credit score. Lenders want to see if you’re responsible with payments—even one missed payment can hurt your score significantly.

✅ How to Keep a Perfect Payment History

📅 Always pay on time—even the minimum payment is better than missing it.

🔔 Set up autopay or reminders to avoid late payments.

☎️ If you missed a payment, contact your lender—they may offer a one-time forgiveness.

👉 Pro Tip: Late payments stay on your credit report for 7 years but have less impact over time—so start making on-time payments today!

2. Credit Utilization (30%) – How Much Credit You Use

Credit utilization is the amount of credit you’re using compared to your total limit. If your credit cards are maxed out, lenders see you as a risk, which can lower your score.

✅ How to Keep Utilization Low

💳 Keep balances below 30% of your credit limit (under 10% is even better).

💸 Pay down high balances before your statement date for a faster score boost.

☎️ Request a credit limit increase—this lowers your utilization instantly.

👉 Pro Tip: Even if you pay your balance in full, your utilization may still appear high if the lender reports before your payment clears.

3. Length of Credit History (15%) – The Age of Your Credit

Lenders prefer to see a long track record of responsible credit use. The longer you’ve had credit accounts open, the better it is for your score.

✅ How to Improve Credit Age

⏳ Keep old credit cards open—closing them shortens your history.

📈 If you’re new to credit, be patient—your score will improve over time.

👨👩👧👦 Become an authorized user on a family member’s old credit card to boost your history.

👉 Pro Tip: Even if you don’t use an old card, keeping it open helps your score as long as it doesn’t have an annual fee.

4. Credit Mix (10%) – Having Different Types of Credit

A good credit mix shows lenders that you can handle different types of credit responsibly. Having only credit cards or only loans might limit your score potential.

✅ How to Diversify Your Credit Mix

🏠 Installment credit – Loans like mortgages, car loans, and student loans.

💳 Revolving credit – Credit cards or lines of credit.

🚗 If you only have credit cards, consider a small personal loan to add variety.

👉 Pro Tip: You don’t need to take on unnecessary debt—just having a mix of credit naturally over time will help.

5. New Credit Inquiries (10%) – Applying for Too Many Accounts

Every time you apply for new credit, the lender does a hard inquiry on your report, which can temporarily lower your score.

✅ How to Avoid Unnecessary Hard Inquiries

🚫 Only apply for credit when necessary.

📆 Space out credit applications at least 6 months apart.

🔍 Check if you’re pre-approved before applying to avoid unnecessary inquiries.

👉 Pro Tip: If you’re shopping for a car loan or mortgage, multiple inquiries within 14-45 days are usually treated as one inquiry for credit scoring purposes.

How to Use These Factors to Your Advantage

Understanding these five key factors is the key to building and maintaining a strong credit score.

🎯 Quick Recap:

✅ Payment History (35%) – Pay on time, every time!

✅ Credit Utilization (30%) – Keep balances low, below 30% (or 10%) of your limit.

✅ Credit Age (15%) – Keep old accounts open for a longer history.

✅ Credit Mix (10%) – Having both credit cards and loans helps.

✅ New Credit (10%) – Avoid applying for too many new accounts at once.

📞 Need help improving your credit? Contact Credit Restore Lab for a FREE consultation today!

CreditRepair #ImproveCreditScore #CreditScoreFactors #FixCreditScore #IncreaseCreditScore #CreditUtilization #PaymentHistory #CreditHistory #AuthorizedUser #CreditInquiries #DebtManagement #FinancialHealth #DisputeCreditErrors #RebuildCredit #CreditMix #CreditRepairServices #RaiseCreditScore #CreditEducation #CreditScoreGuide